Flat tax

|

|

Policies

Government revenue

Tax revenue · Non-tax revenue Law · Tax bracket Exemption · Credit · Deduction Tax shift · Tax cut · Tax holiday Tax advantage · Tax incentive Tax reform · Tax harmonization Tax competition · Double taxation Tax, tariff and trade |

|

Price effect · Excess burden

Tax incidence Laffer curve · Optimal tax |

|

Collection

Revenue service · Revenue stamp

Tax assessment · Taxable income Tax lien · Tax refund · Tax shield Tax residence · Tax preparation Tax investigation · Tax resistance Tax avoidance and evasion Tax shelter · Tax haven Private tax collection · Tax farming Smuggling · Black market |

|

Distribution

Tax rate

Progressive · Regressive · Flat Proportional · Negative (income) |

|

Types

Direct · Indirect · Ad valorem · In rem

Capital gains · Consumption Dividend · Excise · Georgist Gift · Gross receipts · Income Inheritance (estate) · Land value Payroll · Pigovian · Property Sales · Sin · Stamp · Turnover Value-added (VAT) Corporate profit · Excess profits Windfall profits |

|

By country

Tax rates around the world

Tax revenues as %GDP Albania · Australia · Britain · Canada China · France · Germany India · New Zealand United States |

A flat tax (short for flat rate tax) is a tax system with a constant tax rate.[1] A flat tax may also be called a tax in rem ("against the thing"), such as an excise tax on gasoline of three cents per gallon. Usually the term flat tax refers to household income (and sometimes corporate profits) being taxed at one marginal rate, in contrast with progressive taxes that vary according to parameters such as income or usage levels. Flat taxes offer simplicity in the tax code, which has been reported to increase compliance and decrease administration costs.[2]

Flat taxes that allow a tax exemption for household income below a cutoff level are not true proportional taxes, because, for household incomes below the cutoff level, taxable income is less than total income.

Contents |

Tax effects

Distribution

Tax distribution is a hotly debated aspect of flat taxes. The relative fairness hinges crucially on what tax deductions are abolished when a flat tax is introduced, and who profits the most from those deductions.

Proponents of the flat tax claim it is fairer than stepped marginal tax rates, since everybody pays the same proportion. Opponents of the flat tax, on the other hand, claim that since the marginal value of income declines with the amount of income (the last $100 of income of a family living near poverty being considerably more valuable than the last $100 of income of a millionaire), taxing that last $100 of income the same amount despite vast differences in the marginal value of money is unfair.

Discouraging Wasteful Government Spending

Proponents of the flat tax system point out that there is a strong likelihood that another positive effect would be to discourage increased spending by government. The reason for this would be that any tax increase would affect all taxpayers. In the current tax system, government officials are able to win the approval of the public by raising taxes on certain groups to pay for new spending. If everyone's taxes had to go up with any new spending, every new government program would have to be carefully scrutinized. In the long run, the hope would be that government would become more efficient.

Administration and enforcement

A flat tax taxes all income once at its source. Hall and Rabushka (1995) includes a proposed amendment to the US Revenue Code implementing the variant of the flat tax they advocate.[3] This amendment, only a few pages long, would replace hundreds of pages of statutory language (although it is important to note that much statutory language in taxation statutes is not directed at specifying graduated tax rates). As it now stands, the USA Revenue Code is over 9 million words long and contains many loopholes, deductions, and exemptions which, advocates of flat taxes claim, render the collection of taxes and the enforcement of tax law complicated and inefficient. It is further argued that current tax law retards economic growth by distorting economic incentives, and by allowing, even encouraging, tax avoidance. With a flat tax, there are fewer incentives to create tax shelters and to engage in other forms of tax avoidance.

Under a pure flat tax without deductions, companies could simply, every period, make a single payment to the government covering the flat tax liabilities of their employees and the taxes owed on their business income.[4] For example, suppose that in a given year, ACME earns a profit of 3 million, pays 2 million in salaries, and spends an added 1 million on other expenses the IRS deems to be taxable income, such as stock options, bonuses, and certain executive privileges. Given a flat rate of 15%, ACME would then owe the IRS (3M + 2M + 1M) x0.15 = 900,000. This payment would, in one fell swoop, settle the tax liabilities of ACME's employees as well as taxes it owed by being a firm. Most employees throughout the economy would never need to interact with the IRS, as all tax owed on wages, interest, dividends, royalties, etc. would be withheld at the source. The main exceptions would be employees with incomes from personal ventures. The Economist claims that such a system would reduce the number of entities required to file returns from about 130 million individuals, households, and businesses, as at present, to a mere 8 million businesses and self-employed.

This simplicity would remain even if realized capital gains were subject to the flat tax. In that case, the law would require brokers and mutual funds to calculate the realized capital gain on all sales and redemptions. If there were a gain, 15% of the gain would be withheld and sent to the IRS. If there were a loss, the amount would be reported to the IRS, which would offset gains with losses and settle up with taxpayers at the end of the period.

Under a flat tax, the government's cost of processing tax returns would become much smaller, and the relevant tax bodies could be abolished or massively downsized. The people freed from working in administering taxes will then be employed in jobs that are more productive. If combined with a provision to allow for negative taxation, the flat tax itself can be implemented in an even simpler way.

Economic efficiency

A common approximation in economics is that the economic distortion or excess burden from a tax is proportional to the square of the tax rate.[5] A 20 percent tax rate thus causes four times the excess burden or deadweight loss of a 10 percent tax, since it is twice the rate. Broadly speaking, this means that a low uniform rate on a broad tax base will be more economically efficient than a mix of high and low rates on a smaller tax base.

Revenues

Some claim the flat tax will increase tax revenues, by simplifying the tax code and removing the many loopholes currently exploited to pay less tax. The Russian Federation is a claimed case in point; the real revenues from its Personal Income Tax rose by 25.2% in the first year after the Federation introduced a flat tax, followed by a 24.6% increase in the second year, and a 15.2% increase in the third year.[6] The Laffer curve predicts such an outcome, but attributes the primary reason for the greater revenue to higher levels of economic growth. The Russian example is often used as proof of this, although an IMF study in 2006 found that there was no sign "of Laffer-type behavioral responses generating revenue increases from the tax cut elements of these reforms" in Russia or in other countries.[7]

Overall structure

Some taxes other than the income tax (for example, taxes on sales and payrolls) tend to be regressive. Hence, making the income tax flat could result in a regressive overall tax structure. Under such a structure, those with lower incomes tend to pay a higher proportion of their income in total taxes than the affluent do. The fraction of household income that is a return to capital (dividends, interest, royalties, profits of unincorporated businesses) is positively correlated with total household income. Hence a flat tax limited to wages would seem to leave the wealthy better off. Modifying the tax base can change the effects. A flat tax could be targeted at income (rather than wages), which could place the tax burden equally on all earners, including those who earn income primarily from returns on investment. Tax systems could utilize a flat sales tax to target all consumption, which can be modified with rebates or exemptions to remove regressive effects (such as the proposed FairTax in the U.S.[8]).

Border adjustable

A flat tax system and income taxes overall are not inherently border-adjustable; meaning the tax component embedded into products via taxes imposed on companies (including corporate taxes and payroll taxes) are not removed when exported to a foreign country (see Effect of taxes and subsidies on price). Taxation systems such as a sales tax or value added tax can remove the tax component when goods are exported and apply the tax component on imports. The domestic products could be at a disadvantage to foreign products (at home and abroad) that are border-adjustable, which would impact the global competitiveness of a country. However, it's possible that a flat tax system could be combined with tariffs and credits to act as border adjustments (the proposed Border Tax Equity Act in the U.S. attempts this). Implementing an income tax with a border adjustment tax credit is a violation of the World Trade Organization agreement. Tax exemptions (allowances) on low income wages, a component of most income tax systems could mitigate this issue for high labour content industries like textiles that compete Globally.

Around the world

Eastern Europe

Advocates of the flat tax argue that the former-Communist states of Eastern Europe have benefited from the adoption of a flat tax. Most of these nations have experienced strong economic growth of 6% and higher in recent years, some of them, particularly the Baltic countries, experience exceptional GDP growth of around 10% yearly.

- Lithuania, which levies a flat tax rate of 24% (previously 27%) on its citizens, has experienced amongst the fastest growth in Europe. Advocates of the flat tax speak of this country's declining unemployment and rising standard of living. They also state that tax revenues have increased following the adoption of the flat tax, due to a subsequent decline in tax evasion and the Laffer curve effect. Others point out, however, that Lithuanian unemployment is falling at least partly as a result of mass emigration to Western Europe. The argument is that Lithuania's comparatively very low wages, on which a non-progressive flat tax is levied, combined with the possibility now to work legally in Western Europe since accession to the European Union, is forcing people to leave the country en masse. The Ministry of Labour estimated in 2004 that as many as 360,000 workers might have left the country by the end of that year, a prediction that is now thought to have been broadly accurate. The impact is already evident: in September 2004, the Lithuanian Trucking Association reported a shortage of 3,000-4,000 truck drivers. Large retail stores have also reported some difficulty in filling positions.[9] However, the emigration trend has recently stopped as enormous real wage gains in Lithuania (presumably due to the shortage of workers) have caused a return of many migrants from Western Europe. In addition to that, it is clear that countries not levying a flat tax such as Poland also temporarily faced large waves of emigration after EU membership in 2004.

- Whilst in most countries the introduction of a flat tax has coincided with strong increases in growth and tax revenue, there is no proven causal link between the two. For example, it is also possible that both are due to a third factor, such as new government that may institute other reforms along with the flat tax.

- In Estonia, which has had a 26% (24% in 2005, 23% in 2006, 22% in 2007, 21% in 2008, 21% in 2009, planned 20% in 2010, 19% in 2011, 18% in 2012) flat tax rate since 1994, studies have shown that the significant increase in tax revenue experienced was caused partly by a disproportionately rising VAT revenue.[10] Moreover, Estonia and Slovakia have high social contributions, pegged to wage levels.[10] Both matters raise questions regarding the justice of the flat tax system, and thus its long-term viability. The Estonian economist and former chairman of his country's parliamentary budget committee Olev Raju, stated in September 2005 that "income disparities are rising and calls for a progressive system of taxation are getting louder - this could put an end to the flat tax after the next election" [26]. However, this did not happen, since after the 2007 elections a right-wing coalition was formed which has stated its will to keep the flat tax in existence. However, critics argue that the tax rates these countries have are actually more progressive than flat.[11]

- According to a 2010 study[12] published in the Brussels newspaper L'Anglophone, the tax burden for typical workers in Central and Eastern Europe's "flat tax" countries is slightly higher (40.3% versus 40.2% of the total cost of employment) than that of the progressive systems elsewhere in the EU. "Slovakia has a “flat tax” rate of 19%," wrote the authors[13], "but its employers pay a 35.2% contribution to social security (higher than the 34.8% in Belgium) and, in addition to the flat income tax, employees have 13.4% deducted for social security (also higher than the 13.07% in Belgium)," adding that a typical Slovak worker's Tax Freedom Day is a day later than a Finnish worker's.

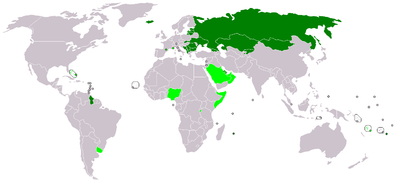

Countries that have flat tax systems

These are countries, as well as minor jurisdictions with the autonomous power to tax, that have adopted tax systems that are commonly described in the media and the professional economics literature as a flat tax.

Iceland [22][24][25] Iceland's system differs from the Hall-Rabushka flat tax by taxing investment income and allowing numerous exceptions.[26]

Iceland [22][24][25] Iceland's system differs from the Hall-Rabushka flat tax by taxing investment income and allowing numerous exceptions.[26]

Also:

- Transnistria, also known as Transnistrian Moldova or Pridnestrovie.[38] This is a disputed territory, but the authority that seems to have de facto government power in the area claims to levy a flat tax.

Countries reputed to have a flat tax

Hong Kong Some sources claim that Hong Kong has a flat tax,[39] though its salary tax structure has several different rates ranging from 2% to 20% after deductions. Taxes are capped at 16% of gross income, so this rate is applied to upper income returns if taxes would exceed 16% of gross otherwise.[40] Accordingly, Duncan B. Black of Media Matters for America, says "Hong Kong's 'flat tax' is better described as an 'alternative maximum tax.'" [41] Alan Reynolds of the Cato Institute similarly notes that Hong Kong's "tax on salaries is not flat but steeply progressive."[42] Hong Kong has, nevertheless, a flat profit tax regime.

Hong Kong Some sources claim that Hong Kong has a flat tax,[39] though its salary tax structure has several different rates ranging from 2% to 20% after deductions. Taxes are capped at 16% of gross income, so this rate is applied to upper income returns if taxes would exceed 16% of gross otherwise.[40] Accordingly, Duncan B. Black of Media Matters for America, says "Hong Kong's 'flat tax' is better described as an 'alternative maximum tax.'" [41] Alan Reynolds of the Cato Institute similarly notes that Hong Kong's "tax on salaries is not flat but steeply progressive."[42] Hong Kong has, nevertheless, a flat profit tax regime.

Countries considering a flat tax system

These are countries where concrete flat tax proposals are currently being considered by influential politicians or political parties.

Panama During the 2008 - 2009 political campaign, presidential candidate Ricardo Martinelli has included on his government plan the replacement of the current tax system implemented by president Martin Torrijos with a 10 or 15% flat tax rate in order to raise employment and wages.

Panama During the 2008 - 2009 political campaign, presidential candidate Ricardo Martinelli has included on his government plan the replacement of the current tax system implemented by president Martin Torrijos with a 10 or 15% flat tax rate in order to raise employment and wages. Hungary[43]

Hungary[43] Poland In 2007 elections, the Civic Platform gained 41.5% of the votes, running on a 15% flat tax as one of the main points in the party program.[44]

Poland In 2007 elections, the Civic Platform gained 41.5% of the votes, running on a 15% flat tax as one of the main points in the party program.[44] Greece There are some articles from 2005 indicating that the Greek government considered a flat tax. If it is still on the table, it apparently hasn't passed yet as of February 2008.[45][46]

Greece There are some articles from 2005 indicating that the Greek government considered a flat tax. If it is still on the table, it apparently hasn't passed yet as of February 2008.[45][46]

In a subsequent section, various proposals for flat tax-like schemes are discussed, these differ mainly on how they approach with the following issues of deductions, defining income, and policy implementation.

Difficulties and nuances in schema

In devising a flat tax system, several practical difficulties must be dealt with, principally with deductions and the identification of when money is earned. We can divide these into fundamental implementation issues and philosophical ones. Identification of philosophical ones is important for countries moving towards a Flat Tax, since in any given country the ideals of financial fairness are the starting point for comparison.

Defining when income occurs

Since a central philosophy of the flat tax is to minimize the compartmentalization of incomes into myriad special or sheltered cases, a vexing problem is deciding when income occurs. This is demonstrated by the taxation of interest income and stock dividends. The shareholders own the company and so the company's profits belong to them. If a company is taxed on its profits, then the funds paid out as dividends have already been taxed. It's a debatable question if they should subsequently be treated as income to the shareholders and thus subject to further tax. A similar philosophical issue arises in deciding if interest paid on loans should be deductible from the taxable income since that interest is in-turn taxed as income to the loan provider.[47] There is no universally agreed answer to what is fair. For example, in the United States, dividends are not deductible[48] but mortgage interest is deductible[49]. Thus a Flat Tax proposal is not fully defined until it differentiates new untaxed income from a pass-through of already taxed income.

Avoiding deductions

In general, the question of how to eliminate deductions is fundamental to the flat tax design: deductions dramatically affect the effective "flatness" in the tax rate. Perhaps the single biggest necessary deduction is for business expenses. If businesses were not allowed to deduct expenses then businesses with a profit margin below the flat tax rate could never earn any money since the tax on revenues would always exceed the earnings. For example, grocery stores typically earn pennies on every dollar of revenue; they could not pay a tax rate of 25% on revenues unless their markup exceeded 25%. Thus corporations must be able to deduct operating expenses even if individual citizens cannot. A practical difficulty now arises as to identifying what is an expense for a business[50]. For example, if a peanut butter maker purchases a jar manufacturer, is that an expense (since they have to purchase jars somehow) or a sheltering of their income through investment. How deductions are implemented will dramatically change the effective total tax, and thus flatness, of the tax.[47] Thus a Flat Tax proposal is not fully defined until it differentiates deductible and non-deductible expenses.

Perhaps the largest logical issue is that if the flat tax system has a large per-citizen deductible (such as the "Armey" scheme below), then it is effectively a progressive tax since the total income tax rate is increasing with increasing income. Any flat tax with an initial threshold deduction is inherently a progressive tax. The admission that such a flat tax is not actually flat at all, would seem to undermine the notion that the "flatness" of the tax is itself a desirable feature. As a result, sometimes the term Flat Tax is actually a shorthand for the more proper marginally flat tax.[47]

Policy

Taxes are often used as instruments of policy. For example, it is common for governments to encourage social policy such as home insulation or low income housing with tax credits rather than constituting a ministry to implement these policies[51] . In a true flat tax system (i.e. one without deductions) such policy mechanisms may be curtailed. In addition to social policy, flat taxes can remove tools for adjusting economic policy as well. For example, in the US short term gains are taxed at a higher rate than long term gains as means to promote long term investment horizons and damp speculative fluctuation.[52] Thus claims that flat taxes are cheaper/simpler to administer than others may need to factor in costs for alternative policy administration.

Recent and current proposals

Flat tax proposals have made something of a "comeback" in recent years. In the United States, former House Majority Leader Dick Armey and FreedomWorks have sought grassroots support for the flat tax (Taxpayer Choice Act). In other countries, flat tax systems have also been proposed, largely as a result of flat tax systems being introduced in several countries of the former Eastern Bloc, where it is generally thought to have been successful, although this assessment has been disputed (see below).[53] This has elicited much interest from countries such as the United Kingdom, where it has gone hand in hand with a general swing towards conservatism.[54]

The countries that have recently reintroduced flat taxes have done so largely in the hope of boosting economic growth. The Baltic countries of Estonia, Latvia and Lithuania have had flat taxes of 24%, 25% and 33% respectively with a tax exempt amount, since the mid-1990s. On 1 January 2001, a 13% flat tax on personal income took effect in Russia. Ukraine followed Russia with a 13% flat tax in 2003, which later increased to 15% in 2007. Slovakia introduced a 19% flat tax on most taxes (that is, on corporate and personal income, for VAT etc., almost without exceptions) in 2004; Romania introduced a 16% flat tax on personal income and corporate profit on January 1, 2005. Macedonia introduced a 12% flat tax on personal income and corporate profit on January 1, 2007 and promised to cut it to 10% in 2008. [28] Albania will be implementing a 10% flat tax from 2008.[55]

In the United States, while the Federal income tax is progressive, seven states — Colorado, Illinois, Indiana, Massachusetts, Michigan, Pennsylvania, and Utah — tax household incomes at a single rate, ranging from 3% (Illinois) to 5.3% (Massachusetts). Pennsylvania even has a pure flat tax with no zero-bracket amount.

Greece (25%) and Croatia are planning to introduce flat taxes. Paul Kirchhof, who was suggested as the next Finance minister of Germany in 2005, proposed introducing a flat tax rate of 25% in Germany as early as 2001, which sparked widespread controversy. Some claim the German tax system is the most complex one in the world.

On 27 September 2005, the Dutch Council of Economic Advisors recommended a flat rate of 40% for income tax in the Netherlands. Some deductions would be allowed, and persons over 65 years of age would be taxed at a lower rate.

In the United States, proposals for a flat tax at the federal level have emerged repeatedly in recent decades during various political debates. Jerry Brown, former Democratic Governor of California, made the adoption of a flat tax part of his platform when running for President of the United States in 1992. At the time, rival Democratic candidate Tom Harkin ridiculed the proposal as having originated with the "Flat Earth Society". Four years later, Republican candidate Steve Forbes proposed a similar idea as part of his core platform. Although neither captured his party's nomination, their proposals prompted widespread debate about the current U.S. income tax system.

Flat tax plans that are presently being advanced in the United States also seek to redefine "sources of income"; current progressive taxes count interest, dividends and capital gains as income, for example, while Steve Forbes's variant of the flat tax would apply to wages only.

In 2005 Senator Sam Brownback, a Republican from Kansas, stated he had a plan to implement a flat tax in Washington, D.C.. This version is one flat rate of 15% on all earned income. Unearned income (in particular capital gains) would be exempt. His plan also calls for an exemption of $30,000 per family and $25,000 for singles. Mississippi Republican Senator Trent Lott stated he supports it and would add a $5,000 credit for first time home buyers and exemptions for out of town businesses. DC Delegate Eleanor Holmes Norton's position seems unclear, however DC mayor Anthony Williams has stated he is "open" to the idea.

Flat taxes have also been considered in the United Kingdom by the Conservative Party. However, it has been roundly rejected by Gordon Brown, then Chancellor of the Exchequer for Britain's ruling Labour Party, who said that it was "An idea that they say is sweeping the world, well sweeping Estonia, well a wing of the neo-conservatives in Estonia", and criticised it thus: "The millionaire to pay exactly the same tax rate as the young nurse, the home help, the worker on the minimum wage".[56]

Flat tax proposals differ in how they define and measure what is subject to tax.

True flat rate income tax

As per the definition at the beginning of the article, a true flat rate tax is a system of taxation where one tax rate is applied to all income with no exceptions.

In an article titled The flat-tax revolution, dated April 14, 2005, The Economist argued as follows: If the goals are to reduce corporate welfare and to enable household tax returns to fit on a postcard, then a true flat tax best achieves those goals. The flat rate would be applied to all taxable income and profits without exception or exemption. It could be argued that under such an arrangement, no one is subject to a preferential or "unfair" tax treatment. No industry receives special treatment, large households are not advantaged at the expense of small ones, etc. Moreover, the cost of tax filing for citizens and the cost of tax administration for the government would be further reduced, as under a true flat tax only businesses and the self-employed would need to interact with the tax authorities.

Critics of the flat tax argue that the marginal dollar to the low income is vastly more vital than that of the high income earner, especially around the poverty level. In their view this justifies a progressive taxation system as the added income gained from a flat tax rate to the rich would not be spent on vital goods and services for survival as they might at the poverty level with reduced taxation. However, true Flat tax proponents necessarily contest the concept of the diminishing marginal utility of money and that a marginal dollar should be taxed differently. [57].

Marginal Flat Tax

When deductions are allowed a 'flat tax' is a progressive tax with the special characteristic that above the maximum deduction, the rate on all further income is constant. Thus it is said to be marginally flat above that point. One conceit to reconcile the difference between a true flat tax and a marginally flat tax is to say that the latter simply excludes certain kinds of funds from being defined as income.

Flat tax with deductions

US Congressman Dick Armey has advocated a flat tax on all income in excess of an amount shielded by household type and size. For example, draft legislation proposed by Armey would allow married couples filing jointly to deduct $26,200, unmarried heads of household to deduct $17,200, and single adults, $13,100. $5,300 would be deducted for each dependent. A household would pay tax at a flat rate of 17% on the excess. Businesses would pay a flat 17% rate on all profits. Others have put forth similar proposals with various rates and deductions. Armey defined income to include only salary, wages, and pensions; capital gains and all other sources of wealth appreciation were excluded from taxation under his proposal.[58]

While campaigning for the American presidency in 1996 and 2000, Steve Forbes called for replacing the income tax - which would have included a repeal of the 16th Amendment - by a tax at the flat rate of 17% of consumption, defined as income minus savings, in excess of an amount determined by the type and size of the household. For example, the exempt amount for a family of four would be $42,000 per year.

Modified flat taxes have been proposed which would allow deductions for a very few items, while still eliminating the vast majority of existing deductions. Charitable deductions and home mortgage interest are the most discussed exceptions, as these are popular with voters and often used.

Hall-Rabushka flat tax

Designed by economists at the Hoover Institution, Hall-Rabushka is a fully developed flat tax on consumption (taxing consumption is thought by economists to be more efficient than taxing income).[59] Loosely speaking, Hall-Rabushka accomplishes this by taxing income and then excluding investment. An individual could file a Hall-Rabushka tax return on a postcard. Robert Hall and Alvin Rabushka have consulted extensively in designing the flat tax systems in Eastern Europe.

Negative income tax

The Negative Income Tax (NIT) which Milton Friedman proposed in his 1962 book Capitalism and Freedom is a type of flat tax. The basic idea is the same as a flat tax with personal deductions, except that when deductions exceed income, the taxable income is allowed to become negative rather than being set to zero. The flat tax rate is then applied to the resulting "negative income," resulting in a "negative income tax" the government owes the household, unlike the usual "positive" income tax, which the household owes the government.

For example, let the flat rate be 20%, and let the deductions be $20,000 per adult and $7,000 per dependent. Under such a system, a family of four making $54,000 a year would owe no tax. A family of four making $74,000 a year would owe tax amounting to 0.2(74,000-54,000) = $4,000, as under a flat tax with deductions. But families of four earning less than $54,000 per year would owe a "negative" amount of tax (that is, it would receive money from the government). E.g., if it earned $34,000 a year, it would receive a check for $4,000.

The NIT is intended to replace not just the USA's income tax, but also many benefits low income American households receive, such as food stamps and Medicaid. The NIT is designed to avoid the welfare trap—effective high marginal tax rates arising from the rules reducing benefits as market income rises. An objection to the NIT is that it is welfare without a work requirement. Those who would owe negative tax would be receiving a form of welfare without having to make a try to obtain employment. Another objection is that the NIT subsidizes industries employing low cost labor, but this objection can also be made against current systems of benefits for the working poor.

See also

Economic Concepts

- Fiscal drag (also known as Bracket creep)

- Taxable income elasticity (also known as Laffer Curve)

Tax Systems

- Consumption tax

- FairTax

- Income tax

- Negative income tax

- Progressive tax

- Real property use tax

- Regressive tax

- Sales tax

- Value added tax

Notes

- ↑ James, Simon (1998) A Dictionary of Taxation, Edgar Elgar Publishing Limited: Northampton, MA

- ↑ Mitchell, Daniel J. (2005-07-07). "A Brief Guide to the Flat Tax". Heritage Foundation. http://www.heritage.org/research/taxes/bg1866.cfm. Retrieved 2009-04-23.

- ↑ Hoover Institution - Books - The Flat Tax

- ↑ Simpler taxes | The flat-tax revolution | Economist.com

- ↑ Louis Kaplow. "Accuracy, Complexity, and the Income Tax," Journal of Law, Economics, and Organization (1998), V14 N1, p.68.[1]

- ↑ The Flat Tax at Work in Russia: Year Three, Alvin Rabushka, Hoover Institution Public Policy Inquiry, www.russianeconomy.org, April 26, 2004

- ↑ The "Flat Tax(es)": Principles and Evidence

- ↑ Boortz, Neal; Linder, John (2006). The FairTax Book (Paperback ed.). Regan Books. ISBN 0-06-087549-6.

- ↑ http://www.state.gov/e/eb/ifd/2005/42068.htm

- ↑ 10.0 10.1 Niedrige Steuer für alle: Osteuropa: Einige Länder haben die Einheitssteuer. Doch sie ist umstritten | ZEIT online

- ↑ Central Eastern Europe and the “Flat” Tax - a follow up

- ↑ Wages and Taxes for the "Average Joe" in the EU 27

- ↑ Belgian Workers’ Wages are Highest-Taxed in Western Europe. Flat tax? Read the Fine Print

- ↑ The Associated Press. "Bulgarian parliament approves 2008 budget that foresees record 3 percent surplus". [2]

- ↑ Daniel Mitchell. "Albania Joins the Flat Tax Club." Cato at Liberty, April 9, 2007. [3]

- ↑ Jonilda Koci. "Albanian government approves 10% flat tax". Southeast European Times, June 4, 2007. [4]

- ↑ Alvin Rabushka. "The Flat Tax Spreads to the Czech Republic." hoover.org, 27 August 2008. [5]

- ↑ Alvin Rabushka. "Estonia Plans to Reduce its Flat-Tax Rate." March 26, 2007. [6]

- ↑ Toby Harnden. "Pioneer of the 'flat tax' taught the East to thrive." Telegraph, April 9, 2005.[7]

- ↑ 20.0 20.1 20.2 20.3 20.4 20.5 20.6 20.7 Michael Keen, Yitae Kim, and Ricardo Varsano. "The 'Flat Tax(es)': Principles and Evidence." IMF Working Paper WP/06/218.[8]

- ↑ Alvin Rabushka. "The Flat Tax Spreads to Georgia." January 3, 2005

- ↑ 22.0 22.1 22.2 22.3 22.4 Alvin Rabushka. "Flat and Flatter Taxes Continue to Spread Around the Globe." January 16, 2007.[9]

- ↑ The Economist Intelligence Unit, Kazakhstan fact sheet. "In 2007 Kazakhstan introduced several changes to the taxation system. The flat-rate VAT on all goods was reduced from 15% to 14%, and a flat rate of income tax of 10% was introduced, in place of the previous progressive range of 5-20%." [10]

- ↑ Daniel Mitchell. "Iceland Comes in From the Cold With Flat Tax Revolution." March 27, 2007.[11]

- ↑ The Globe and Mail, as quoted on Cato-at-liberty by Daniel Mitchell: "Effective this year, Iceland (population: 300,000) taxes all personal income at a flat rate of 32 per cent — which appears high because it includes municipal as well as national taxes." [12]

- ↑ Daniel Mitchell. "Iceland Joins the Flat Tax Club." Cato Tax and Budget Bulletin, February 2007. [13]

- ↑ Daniel Mitchell. "If a Flat Tax is Good for Iraq, How About America?" Heritage foundation, November 10, 2003. [14].

- ↑ Alvin Rabushka. "The Flat Tax in Iraq: Much Ado About Nothing—So Far." May 6, 2004. [15]

- ↑ Noam Chomsky. "Transfer real sovereignty." znet, May 11, 2004

- ↑ http://ec.europa.eu/economy_finance/publications/publication415_en.pdf

- ↑ Alvin Rabushka. "A Competitive Flat Tax Spreads to Lithuania." November 2, 2005.[16]

- ↑ "The lowest flat corporate and personal income tax rates." Invest Macedonia government web site. Retrieved June 6, 2007. [17]

- ↑ Alvin Rabushka. "The Flat Tax Spreads to Mongolia." January 30, 2007

- ↑ Alvin Rabushka. "The Flat Tax Spreads to Montenegro." April 13, 2007

- ↑ Alvin Rabushka. "Russia adopts 13% flat tax." July 26, 2000

- ↑ Alvin Rabushka. "The Flat Tax Spreads to Serbia." March 23, 2004

- ↑ Alvin Rabushka. "The Flat Tax Spreads to Ukraine." May 27, 2003

- ↑ Transnistrian government web site

- ↑ Daniel Mitchell. "Fixing a Broken Tax System with a Flat Tax." Capitalism Magazine, April 23, 2004.[18]

- ↑ Duncan B. Black. "Hyman falsely claimed Hong Kong imposes flat tax on income," Media Matters, Jan 27, 2005. [19]

- ↑ Duncan B. Black. "Fund wrong on Hong Kong 'flat tax'." Media Matters, Feb 28, 2005. [20]

- ↑ Alan Reynolds. "Hong Kong's Excellent Taxes." townhall.com, but the column was syndicated. June 6, 2005. [21]

- ↑ Hungary govt plans flat tax, public sector wage cut -report

- ↑ "Poland brings in flat tax", Adam Smith Institute

- ↑ Greece joins the flat rate tax bandwagon. By George Trefgarne, Economics Editor. The Telegraph. 2005. [22]

- ↑ "Flat tax rate on the cards." Kathimerini. 11 July 2005

- ↑ 47.0 47.1 47.2 See for example the flat tax resources at idebate.org ]

- ↑ Dividends are deductible in rare instances[23]

- ↑ IRS Tax pub 936. the mortgage interest deduction[24]

- ↑ Deductible bussiness expenses [25]

- ↑ For example the ENERGYSTAR tax credit

- ↑ As a recent example, transaction costs to damp speculation proposed by James Tobin, winner of the 1972 Nobel prize in economics, were recently (2009) proposed to the G20 by British PM Gordon brown as a way to prevent international currency speculation. Krugman

- ↑ Flat-Tax Comeback Bruce Bartlett, National Review, November 10, 2003

- ↑ Cameron is no moderate, Neil Clark, The Guardian October 24, 2005

- ↑ Albanian government to implement flat tax (SETimes.com)

- ↑ Gordon Brown's speech to the Labour party conference September 26, 2005

- ↑ The diminishing marginal utility means that the number of units of additional 'happiness' afforded by an extra unit of additional money, decreases as one spends more money. [http://www.daviddfriedman.com/Academic/Price_Theory/PThy_Chapter_4/PThy_Chapter_4.html

- ↑ The Armey Flat Tax, National Center for Policy Analysis

- ↑ Hoover Institution - Books - The Flat Tax

References

- Steve Forbes, 2005. Flat Tax Revolution. Washington: Regnery Publishing. ISBN 0-89526-040-9

- Robert Hall and Alvin Rabushka, 1995 (1985). The Flat Tax. Hoover Institution Press.

- Anthony J. Evans, "Ideas and Interests: The Flat Tax" Open Republic 1(1), 2005

External links

- The Laffer Curve: Past, Present and Future: A detailed examination of the theory behind the Laffer curve, and many case studies of tax cuts on government revenue in the United States

- Podcast of Rabushka discussing the flat tax Alvin Rabushka discusses the flat tax with Russ Roberts on EconTalk.